By Michael Phillips | TXBayNews

A massive new data center campus planned for north Fort Worth underscores both the strength—and the growing tension—inside Texas’ pro-growth economic model.

According to reporting by the Houston Chronicle, Spanish infrastructure giant ACS Group is moving forward with plans for a $2.1 billion hyperscale data center campus on a 107-acre site near Hicks Field Road, just north of the AllianceTexas development. If completed as planned, the project would rank among the largest data center investments in North Texas.

Supporters see the project as further proof that Texas remains one of the most attractive destinations in the world for large-scale technology and infrastructure investment. Critics argue it raises familiar questions about tax incentives, grid strain, and whether the public return matches the scale of corporate subsidies.

What’s Being Built

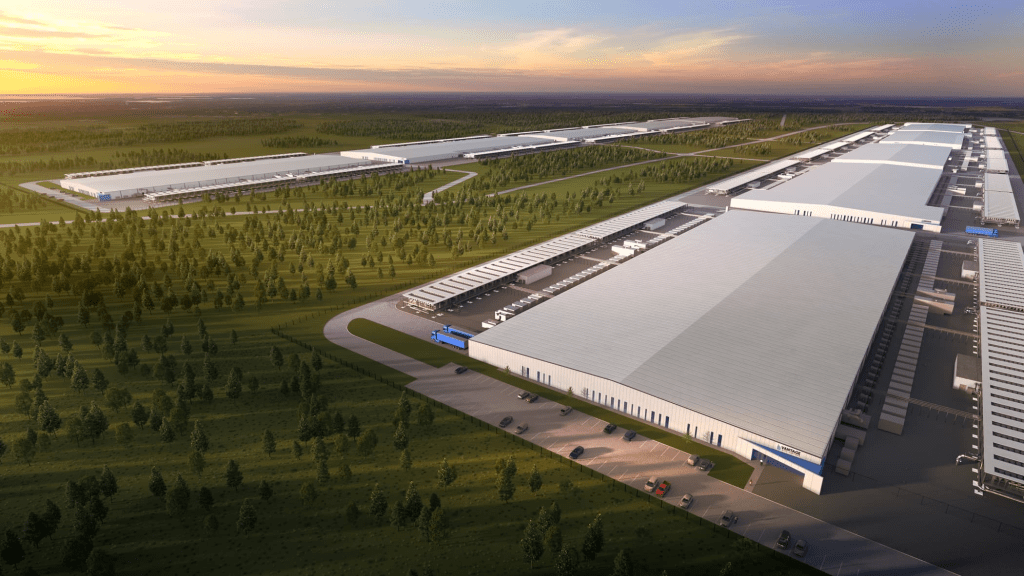

The ACS project is planned as a five-building campus, beginning with a two-story, roughly 251,000-square-foot facility scheduled to break ground in early 2026. The first phase is expected to be completed by June 2027, with full build-out stretching into the early 2030s.

While the eventual end user has not been publicly disclosed, city officials have described ACS’s client base as “impressive,” fueling speculation that the site could ultimately serve a major AI or cloud-computing company. ACS has previously worked with firms such as Meta, Google, Microsoft, and Apple.

The campus will also include a dedicated Oncor Electric substation, highlighting the immense power demands typical of modern hyperscale data centers.

Incentives and Jobs: The Core Debate

Fort Worth approved a 10-year tax abatement for the project earlier this year. In exchange, ACS has committed to:

- $481.6 million in real property improvements

- $1.7 billion in equipment investment

- 37 permanent jobs by 2034, with an average salary of at least $150,000

- An estimated $57–58 million in net tax revenue for the city over a decade

From a center-right economic perspective, supporters argue this is a clear win: billions in private capital, high-paying technical jobs, and long-term tax revenue with minimal strain on public services like schools or roads.

Critics—often from both the left and fiscally conservative wings of the right—counter that the jobs-to-investment ratio remains extremely low, raising concerns about whether such abatements amount to corporate welfare for global tech firms.

Why Location Matters

Unlike some recent data center proposals in Fort Worth that triggered neighborhood backlash, the Hicks Field Road site sits within an already industrialized corridor near AllianceTexas—a long-established logistics and data center hub that includes Meta’s existing campus.

There has been no organized local opposition reported so far. The land is zoned for heavy industrial use, and nearby infrastructure—power, fiber, and transportation—was built with projects like this in mind.

This distinguishes the ACS campus from more controversial proposals elsewhere in the city that placed facilities closer to residential neighborhoods or environmentally sensitive areas.

Power, Water, and the Texas Grid

ACS has emphasized that the Fort Worth campus will use closed-loop cooling systems designed to minimize water usage, along with quieter designs and buffer zones to reduce noise.

Still, the broader issue remains difficult to ignore. Texas is in the middle of an AI-driven data center boom, with hundreds of large-load requests already in ERCOT’s pipeline. Some analysts warn that speculative projects could clog grid planning and shift infrastructure costs onto ratepayers if demand projections fall short.

Supporters argue the opposite: that data center growth incentivizes new generation, modernizes the grid, and can even help stabilize it through voluntary load-shedding during peak demand.

A National Trend Playing Out in Texas

What’s happening in Fort Worth mirrors trends across the country. States from Virginia to Arizona to Georgia are competing aggressively for hyperscale data centers using tax exemptions and abatements, often with similarly low permanent job counts.

Texas sits squarely in the middle of this national race—offering cheap energy, ample land, and a light regulatory touch that appeals to global investors.

From a center-right viewpoint, the choice is stark: compete—or watch investment flow elsewhere.

The Bigger Picture

The ACS project highlights a central tension in modern economic development. Data centers don’t look like factories of the past. They employ fewer people, consume more power, and rely heavily on incentives. Yet they also underpin nearly every sector of the modern economy—from national defense and artificial intelligence to finance and healthcare.

For Texas leaders, the Fort Worth project reflects a bet that being at the center of the digital economy outweighs the risks. Whether that bet pays off will depend not just on this campus, but on how the state manages cumulative growth across its grid, water systems, and tax base.

For now, the cranes are coming—and Fort Worth is once again at the front line of Texas’ high-stakes growth strategy.

Leave a comment